Slippage in trade execution can make or break a trader’s strategy. It happens when there’s a difference between the expected price of a trade and the price at which it is actually executed. Understanding why slippage occurs and how to manage it is crucial for any trader looking to minimize losses and maximize gains. Slippage in trade execution can be minimized with the right knowledge, and Immediate Flow connects traders with educational experts to help.

Defining Slippage: An In-Depth Perspective

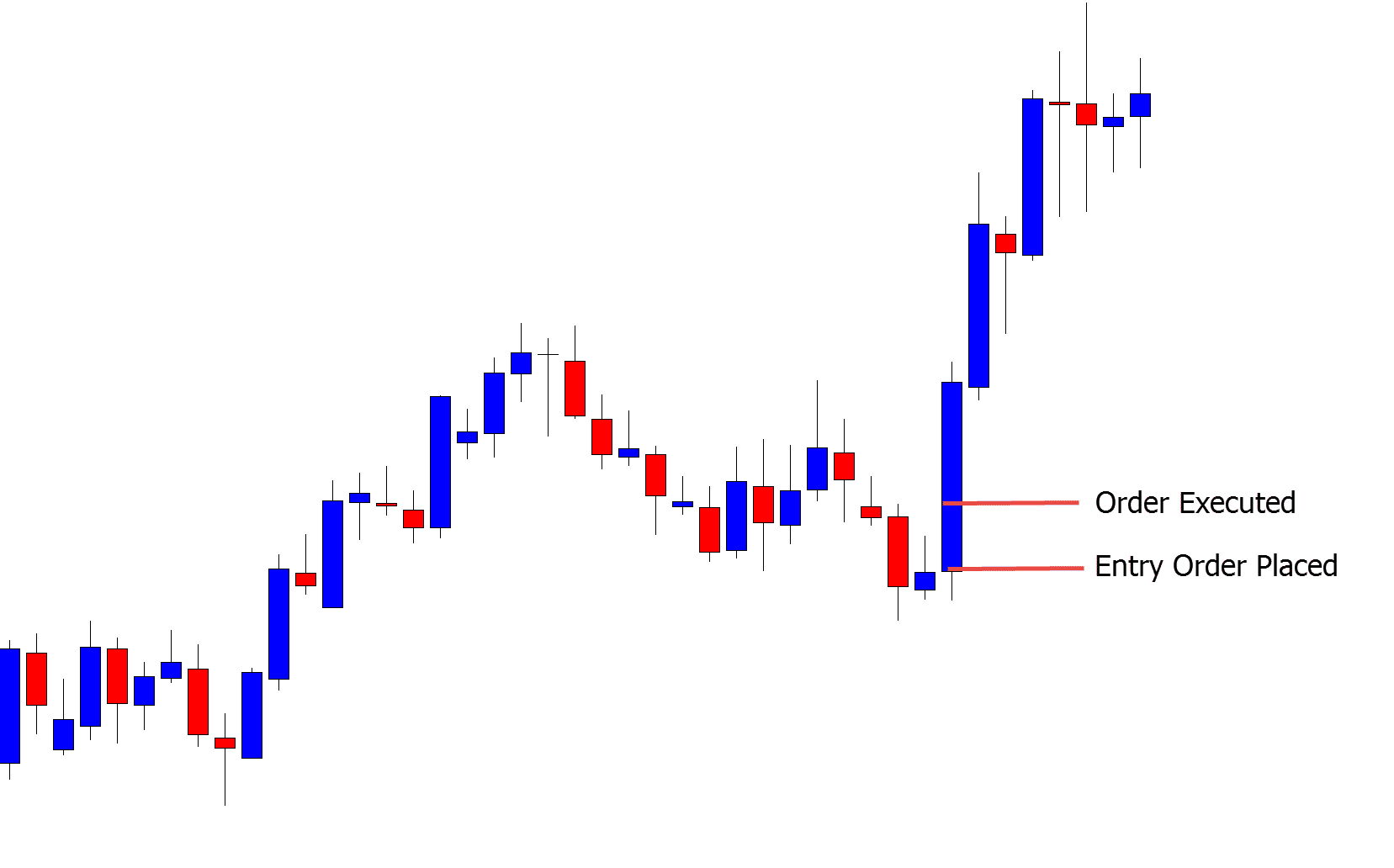

Slippage occurs when the actual price of a trade execution differs from the expected price. This discrepancy can result in either positive or negative outcomes. Positive slippage happens when a trade is executed at a better price than anticipated, while negative slippage means the trade is executed at a worse price.

Slippage often occurs in fast-moving markets where prices can change rapidly in seconds. For example, during high-impact news releases or major economic events, the volatility can cause significant price shifts. Traders using market orders are more susceptible to slippage because these orders are executed at the best available price, which can vary in volatile conditions.

Understanding slippage is vital for traders because it can impact the overall profitability of their trades. Managing slippage involves using strategies such as limit orders, which set a maximum or minimum price for execution, thus providing some control over the trade price. Ultimately, recognizing and mitigating slippage can help traders make more informed decisions and enhance their trading performance.

Factors Contributing to Slippage

Several factors contribute to slippage, with market volatility being a primary one. High volatility means prices can change rapidly, making it challenging to execute trades at the desired price. Liquidity is another critical factor. In markets with low liquidity, fewer buyers and sellers are available, increasing the likelihood of price shifts during order execution.

Trade size also plays a role; large orders can move the market price, causing slippage. Order type affects slippage as well. Market orders, which are executed at the best available price, are more prone to slippage than limit orders, which are executed only at a specified price or better.

Additionally, the time of day can influence slippage. For example, trading during off-hours or during market openings and closings can increase the chance of slippage due to reduced liquidity or increased volatility. By understanding these factors, traders can develop strategies to minimize slippage, such as trading during periods of high liquidity or using limit orders to control execution prices.

Quantifying Slippage: Methods and Metrics

Quantifying slippage involves measuring the difference between the expected and actual execution prices. One common method is to calculate the slippage percentage. This is done by taking the difference between the expected price and the execution price, dividing it by the expected price, and then multiplying by 100.

For example, if the expected price was $100 and the execution price was $101, the slippage would be 1%. Another approach is to use the slippage cost in dollar terms, which is simply the difference between the expected and actual prices multiplied by the number of shares or contracts traded.

Traders also analyze historical data to identify patterns and understand how slippage varies under different market conditions. Tracking slippage over time can help traders refine their strategies and improve their execution quality. Tools and platforms that offer detailed trade execution reports can provide valuable insights into slippage, helping traders to make more informed decisions and optimize their trading performance.

Slippage in Different Trading Environments

Slippage can vary significantly across different trading environments. In highly liquid markets, such as major forex pairs or blue-chip stocks, slippage is generally lower due to the abundance of buyers and sellers.

Conversely, in less liquid markets, such as small-cap stocks or exotic forex pairs, slippage tends to be higher. During high-impact news events or periods of economic uncertainty, slippage can increase due to heightened volatility. Additionally, slippage is often more pronounced in after-hours trading sessions, where lower trading volumes can lead to larger price gaps.

Different asset classes also experience varying levels of slippage. For example, futures contracts might exhibit different slippage characteristics compared to equities or forex. Traders need to consider these differences when planning their trades. By understanding how slippage behaves in various trading environments, traders can adjust their strategies accordingly, such as avoiding trading during high-volatility periods or using limit orders to gain more control over their trade execution prices.

Conclusion

Mastering slippage is essential for successful trading. By understanding its causes and learning how to measure and mitigate its impact, traders can improve their execution and overall performance. Always stay informed and prepared, as even the slightest misstep can have significant financial consequences.

Be First to Comment