Choosing the right life insurance policy plans can be a daunting task, given the variety of options available. Understanding the different types of life insurance is crucial to making an informed decision. This guide will help you navigate through the various types of life insurance and how to select the best life insurance policy plans for your needs.

Understanding the Types of Life Insurance

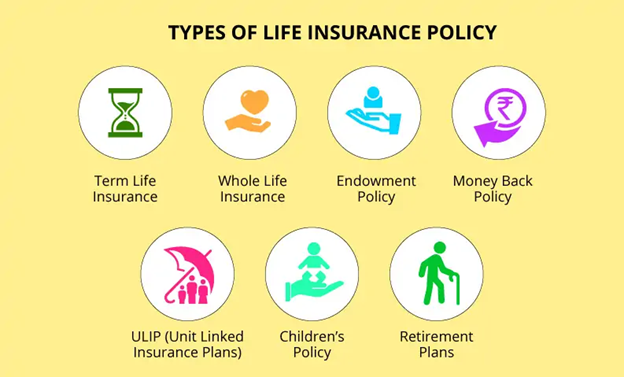

Life insurance policy plans come in different forms, each designed to meet specific financial goals and protection needs. Here are the primary types of life insurance:

Term Life Insurance

Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years. If the policyholder dies during the term, the beneficiaries receive the death benefit. This type of insurance is straightforward and typically offers the highest coverage for the lowest premiums.

Whole Life Insurance

Whole life insurance offers lifetime coverage and includes a savings component known as the cash value, which grows over time. Premiums are generally higher than those of term life insurance, but the policy guarantees a death benefit as long as premiums are paid.

Universal Life Insurance

Universal life insurance is a flexible policy that combines death benefit protection with a savings element that earns interest. Policyholders can adjust their premiums and death benefits within certain limits, making it a versatile option.

Endowment Plans

Endowment plans provide a lump sum payment upon maturity or death, whichever comes first. These plans are designed to offer both insurance and investment benefits, making them suitable for long-term financial planning.

Money Back Policies

Money back policies provide periodic returns of a portion of the sum assured during the policy term, along with the full sum assured upon maturity or death. This type of policy ensures liquidity at regular intervals, which can be beneficial for meeting short-term financial goals.

Unit-Linked Insurance Plans (ULIPs)

Unit-Linked Insurance Plans (ULIPs) offer a combination of insurance and investment. Part of the premium is used for life insurance coverage, while the remainder is invested in various funds. The policy’s value fluctuates based on the performance of these investments.

Key Features to Consider in Life Insurance Policy Plans

When evaluating different life insurance policy plans, consider the following key features to ensure you choose the best option:

- Coverage Amount: The sum assured should be sufficient to cover your family’s financial needs, including daily living expenses, education costs, and outstanding debts.

- Premiums: Ensure the premiums are affordable and provide good value for the coverage offered. Compare different policies to find the best balance between cost and coverage.

- Policy Term: The duration of the policy should align with your financial goals and obligations. Some plans offer coverage up to age 99 or even lifelong coverage.

- Riders: Additional benefits such as critical illness cover, accidental death benefit, and waiver of premium can enhance your policy’s coverage. Consider adding these riders based on your specific needs.

- Cash Value: For policies like whole life and ULIPs, consider the growth potential of the cash value component. This can be an important factor for long-term financial planning.

How to Choose the Best Life Insurance Policy Plans

Selecting the best life insurance policy plans involves a careful assessment of your financial needs and comparing different types of life insurance. Here are some steps to guide you:

Assess Your Financial Needs

Determine the amount of coverage you need based on your financial responsibilities and future goals. Consider factors such as outstanding debts, daily living expenses, education costs, and any long-term financial commitments.

Compare Different Policies

Use online tools to compare various life insurance policy plans. Look at the coverage amounts, premium costs, policy terms, and additional benefits offered by each plan. This comparison will help you identify the policies that best meet your needs.

Check the Insurer’s Reputation

Research the insurance company’s claim settlement ratio and customer reviews. A high claim settlement ratio indicates the insurer’s reliability in honoring claims, providing peace of mind that your beneficiaries will receive the benefits.

Read the Fine Print

Carefully read the policy documents to understand the terms, conditions, and exclusions. Make sure you are aware of any limitations or restrictions that might affect your coverage.

Consult a Financial Advisor

If needed, consult a financial advisor to get personalized recommendations based on your financial situation and goals. An advisor can provide valuable insights and help you make an informed decision.

Making the Right Choice for Your Future

Choosing the best life insurance policy plans involves understanding the different types of life insurance and evaluating your financial needs. By comparing various plans and considering factors such as coverage, premiums, and additional benefits, you can select a policy that provides financial security for you and your loved ones. Remember to assess your needs, compare policies, check the insurer’s reputation, and consult a financial advisor if necessary to make an informed decision. Investing in the right life insurance policy plan can ensure peace of mind and financial stability for the future.

Be First to Comment