The Sydney trading session is where the global financial day begins, setting the stage for markets worldwide. As the first major market to open, it plays a crucial role in shaping trends and sentiments. Dive into the world of the Sydney session to uncover its unique features, strategic timing, and significant impact on Forex dynamics. Magnumator 2.0 connects traders with experts who can elucidate the importance of the Sydney trading session in the global market.

The Role of the Sydney Session in the Financial Ecosystem

The Sydney trading session kicks off the trading day. It sets the tone for markets around the globe. Being the first major market to open, Sydney plays a key role in establishing initial trends and sentiments. Traders keep an eye on movements here to gauge market direction. This session connects Asian markets with those in the U.S. and Europe, creating a seamless flow of trading activities.

Activity during the Sydney session can influence other markets. For instance, if Australian companies report earnings or significant economic data is released, it can impact currencies and commodities. The session also overlaps with the Tokyo session, adding liquidity and volatility. This overlap creates opportunities for traders, especially in the Forex market.

Sydney’s market is unique due to its focus on commodities, given Australia’s rich natural resources. Mining and agricultural stocks are prominent. This focus impacts commodity prices globally, from metals to agricultural products. Investors worldwide monitor Sydney for trends in these areas.

Strategic Timing and Its Global Implications

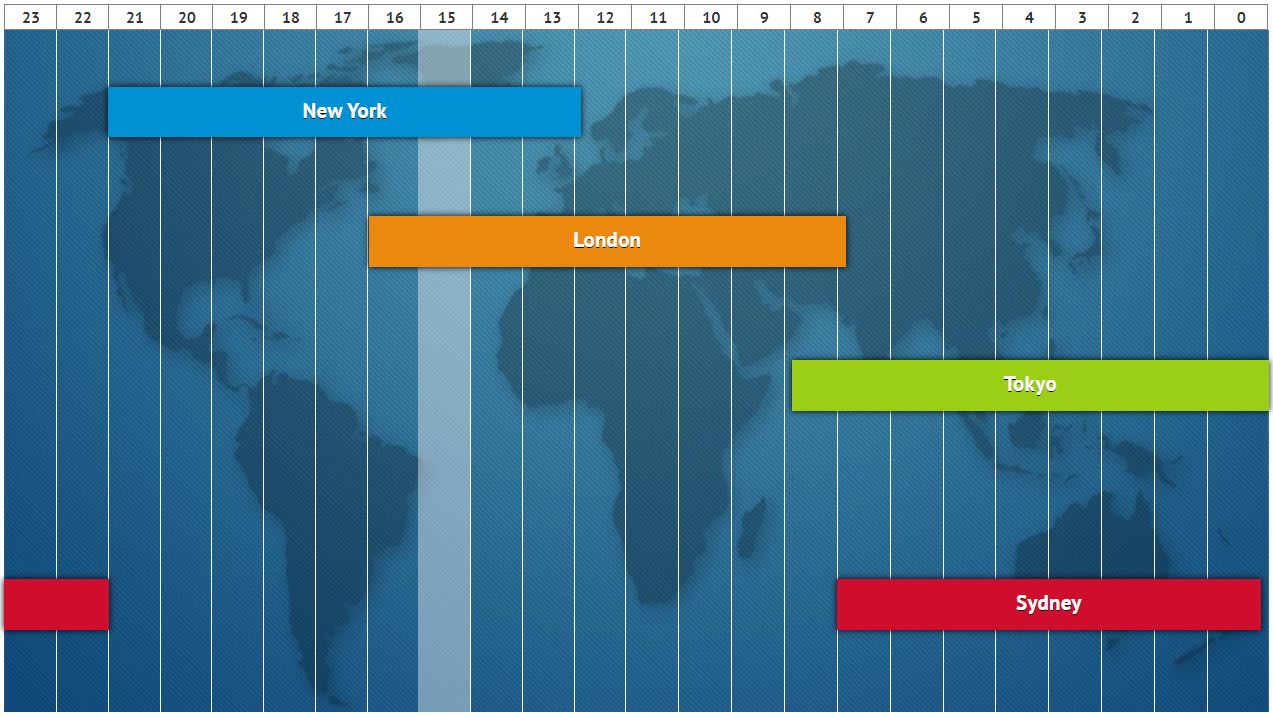

Timing in trading is crucial, and the Sydney session is perfectly placed. It begins when most of the world is still asleep, bridging the gap between the end of the New York session and the start of the Tokyo session. This timing creates a continuous trading cycle, reducing gaps and providing smoother transitions. For traders, this means fewer surprises and more predictable movements.

The overlap between the Sydney and Tokyo sessions is a golden period. It increases liquidity and trading volume. With both markets active, traders see tighter spreads and more opportunities. This overlap also means that economic news from both regions can have an amplified impact. For instance, if Australia releases employment data while Japan’s market is open, the reaction can be more pronounced.

The Sydney session also sets the stage for the day ahead. Early trends and sentiment in Sydney can influence trading strategies in Tokyo, London, and New York. Traders often look to Sydney for clues on how the day might unfold. This early activity can shape the strategies of investors globally, from day traders to long-term investors.

Key Characteristics of the Sydney Trading Session

The Sydney trading session has unique traits that distinguish it from other sessions. It starts at 10 PM GMT and runs until 7 AM GMT. This timing makes it the first major market to open each day, setting the stage for global trading. The session is known for its relatively low volatility compared to the London or New York sessions, but this can change quickly with significant news or economic data releases.

A key feature of the Sydney session is its focus on the Australian and New Zealand dollars. These currencies often see more movement due to local economic data. Traders interested in these currencies pay close attention to this session. Additionally, commodities like gold and oil are influenced by movements in the Australian market due to the country’s strong ties to natural resources.

The overlap with the Tokyo session, as mentioned earlier, is another characteristic. This overlap period sees increased trading volume and volatility. It provides traders with more opportunities for profit, especially in the Forex market. Stocks listed on the Australian Securities Exchange (ASX) are also actively traded during this time, impacting local and global markets.

Sydney Session and Forex Market Dynamics

The Sydney session plays a vital role in the Forex market. It kicks off the trading week, setting the tone for currency movements. While it might be quieter compared to later sessions, it’s a key time for traders who focus on the Australian and New Zealand dollars. These currencies often see more action due to local economic news and data releases.

Liquidity is generally lower during the Sydney session compared to the London or New York sessions. However, this can change quickly with significant news. For example, an unexpected change in Australian interest rates can cause sharp movements in the AUD/USD pair. Traders use this time to position themselves ahead of major announcements, making the session an essential part of their strategy.

Conclusion

The Sydney trading session is indispensable in the global financial landscape. Its strategic timing, unique market characteristics, and influence on Forex make it a vital part of trading. Understanding its nuances can provide traders with valuable insights and opportunities, setting the foundation for a successful trading day.

Be First to Comment