With the rising trend of online insurance, the days of driving to an insurance agent’s office to purchase a policy is now over. This new convenience has revolutionized the industry, making it easier, more affordable and seamless for people to purchase the coverage they need. You can just easily ask your agent to meet you in a cafe or in any place that’s convenient for you.

The emergence of internet insurance has fundamentally altered how we see insurance. In the past, buying insurance was a lengthy, intricate procedure that involved a ton of paperwork, which made it challenging and expensive to do so. However, since the internet’s invention, insurance firms have found it considerably simpler and more cost-effective to provide insurance to customers.

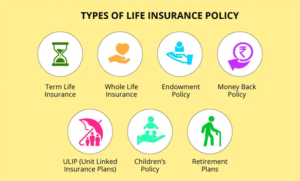

Online insurance has come a long way. Today, there are types of online insurance that you can purchase to protect yourself, your family, and your belongings. Here are the types of online insurance in Singapore for you to consider:

- Life Insurance

Life insurance provides coverage against a loss of life, a way to protect your loved ones in the event of your death. Life insurance policies can be tailored to fit your family’s individual needs, and they are often much more affordable than traditional life insurance policies. Check out more about Term Life Insurance and Whole Life Insurance to know which one fits for your family’s needs.

- Health Insurance

Health insurance gives you a sense of security, knowing that you’re covered in the case of any medical emergency. There are a variety of health insurance plans available online, from basic plans to more comprehensive plans that cover a wider range of medical services and treatments.

- Travel Insurance

You don’t have to worry about unexpected and unfortunate events when you have a travel insurance policy in place. With online travel insurance, you can purchase a policy anywhere, anytime – making it one of the most convenient types of online insurance. It can be used to cover medical expenses, lost luggage, interruption due to inclement weather, and more to ensure that your travels go as smoothly as possible.

- Car Insurance

Car insurance is a must for anyone who owns a vehicle, as it will protect you in the event of an accident. You’ll need to provide information about the make and model of your car, along with details about your driving history and any other drivers who may be on the policy.

- Homeowners or Renter’s Insurance

This type of insurance provides protection for your home and its contents, as well as liability coverage if someone is injured on your property. It also covers the cost of repairs if your home is damaged due to a covered event, such as a fire. It’s important to note that your policy may also include additional coverage, such as flood insurance or extended coverage for certain items like jewelry or art.

How Online Insurance is Reshaping the Industry

Online insurance has revolutionized the industry, allowing customers access to more affordable and comprehensive policies. With the click of a button, customers can compare quotes, purchase coverage and manage their policies from the comfort and convenience of their own homes. This has broken down the barriers that previously existed between customers and their insurance providers, leading to an improved level of service and greater customer satisfaction.

The insurance industry is seeing a massive shift as the world moves online. With the increasing availability of digital tools and platforms, the traditional paper-based systems of the past are being replaced by more efficient and cost-effective digital solutions. Online insurance is proving to be a dynamic and powerful force in the insurance industry, reshaping the way that we buy, use, and manage our policies.

The ability to access policies and information online has drastically changed the way that insurance companies interact with their customers.

Be First to Comment