ADSS (ADS Securities) is a GCC-based broker operating in the United Arab Emirates. Founded in 2011, the execution-only broker is authorised and regulated by the SCA (Securities and Commodities Authority) in the UAE. It provides over-the-counter (OTC) derivatives contracts on stocks, indices, commodities, crypto, and forex, and access to the forex spot markets.

Our verdict on ADSS

In our opinion, ADSS is a reputable broker that offers strong trading infrastructure and integrity in its account structure and broker offerings.

Overall rating: 4.5/5

The broker at a glance

ADSS offers a range of traders – of different experience levels – a solid experience with its robust trading platforms and wide range of offerings. They offer CFDs on stocks, indices, commodities, forex, and crypto, as well as spot currency pair trading. As a broker operating in the UAE, its website is bilingual in English and Arabic, and 24/5 customer support is available in various languages, including English, Arabic, French, German, and Italian.

Pros of ADSS

- Choice of two intuitive platforms – MT4 and their proprietary (ADSS) trading platform

- Instrument pages across financial markets that allow traders to track prices in real time

- Good offering of educational content from a large financial glossary to think-pieces in English and Arabic

- Excellent economic calendar

- Commission-free trading on most trades

- Use of leverage

- Well-established within the Middle East, having won awards for its trading platform and forex trading services

- Use of UAEPass for UAE nationals wishing to register with the broker

- Funding of accounts with ApplePay or Samsung Pay

Cons of ADSS

- Lack of options or futures trading

- No integration with Autochartist, limiting MT4 functions

- No Crypto CFD trading on MT4

Range of offerings

ADSS is an execution-only broker, and it offers spot trading of currency pairs and CFD trading of indices, stocks, commodities, cryptocurrencies, and forex. All trades are commission-free, and they offer competitive spreads. Leverage between 4:1 and 500:1 is available, depending on the asset.

Forex

ADSS offers spot trading and CFD trading on over 65 currency pairs, including major ones like EUR/USD and GBP/JPY and minor ones involving currencies like the UAE dirham, the Saudi riyal, the Hong Kong dollar, and the Singapore dollar. Leverage of up to 500:1 is available on FX majors.

Stocks

ADSS does not facilitate the buying and selling of shares, but it does offer CFD stock trading. Leverage of up to 20:1 is available. The good thing about ADSS’s location in the GCC is that while they offer access to the world’s largest stocks, such as Amazon, Nike, and Tesla, they also offer GCC-centred stocks from the UAE, Kuwait, Saudi Arabia, Bahrain, and more.

Commodities

CFDs on commodities are available, with leverage varying depending on the exact asset. ADSS offers a range of commodities, including metals (gold, palladium, platinum), energy (oil and gas), and agriculture (wheat, cocoa, coffee). This is a good range of assets for speculation and hedging, and there is an opportunity to create a diverse portfolio for traders of all experience levels. Commodities are traded per whole tick.

Indices

Index CFD trading is available at ADSS, with leverage of up to 333:1. Major stock exchange indices include the FTSE 100, the Nikkei 225, the Hang Seng Index, and the DAX are all available for speculation.

Cryptocurrencies

ADSS offers only four cryptocurrencies for speculation with CFDs – Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. Leverage of up to 4:1 is available, and as trading takes place using the broker’s trading platform (or on MT4), there is no need to create an additional online crypto wallet.

Account types

ADSS offers three account tiers. A Classic account, an Elite account, and an Elite+ account. All currencies are denominated in US dollars.

The Classic account is for retail traders only, with a minimum deposit of $100. This is a low starting threshold, which is encouraging for beginners and intermediate traders. Classic account holders benefit from tight spreads and the full range of product offering, as well as access to either MT4 (excepting Crypto CFDs) or the ADSS trading platform.

The Elite and Elite+ accounts are available for institutional and professional traders, with minimum deposit requirements of $100,000 and $250,000 respectively. Both accounts even tighter spreads than the Classic account does, and both come with a designated desk manager. Users of these accounts benefit substantially from ADSS’ partnership with 8 liquidity providers, prime brokerage services such as white labelling, margin solutions, and advanced hosting and colocation (LD4 in London and NY4 in New York).

Registration for UAE nationals are significantly simplified with UAEPass, which allows documents to be submitted and verified entirely online. Funding of the accounts can also be done via ApplyPay and Samsung Pay – which are two of ADSS’s latest additions that aim to simplify the funding process.

There is also a demo account available, and registration can be done on the ADSS website. There is no need to input any credit card information, though the demo account does cease to work after 60 days. The demo account allows traders to test out the MT4 trading platform and practise trading. However, there are limitations – most of it related to trading psychology. Undeniably, it is a different trading experience trading on demo compared to placing live trades.

Fees

Trading fees typically come hand in hand with account opening, maintenance, and fund withdrawal policies. Execution of most trades is commission-free (though overnight charges may still apply), so the bulk of the fees come from spreads.

Minimum spreads at ADSS begin from 1.2 pips or $16.00 per 1.0 standard round lot. Spreads vary for forex pairs depending on whether they are major, minor, or exotic pairs, but they are generally tight, with higher account tiers having even tighter spreads.

Equity (stock) CFDs do cost a small commission fee of 0.20%, but swap rates are reasonable. There is also a 1.00% currency conversion fee for those who wish to convert currencies in-account, and a $5 minimum withdrawal charge.

Trading platforms

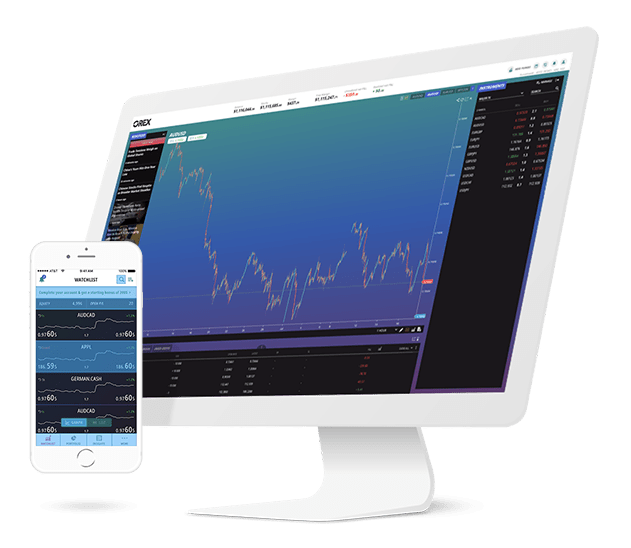

ADSS offers trading on MT4 and on its ADSS trading platform. While we are all more or less familiar with the MT4 platform, it is worth discussing the functions of the ADSS proprietary platform. The ADSS platform is available on desktop and mobile, and it has an intuitive interface that is extremely suitable for traders with less experience.

The ADSS platform is fully customisable, and it is equipped with one-click charting and detailed deal tickets. Traders can scalp and hedge on the platform, and the broker’s extensive network of liquidity providers give way to fast execution and low latency trading with minimal slippage.

Research and education

ADSS offers a range of research and educational tools in English and Arabic. Though the broker states clearly that it does not offer financial advice, there is often a good range of articles that discuss market trends, movements, and larger economic developments which can offer inspiration for traders. There is also the option of a bilingual glossary in English and Arabic for those who are getting into trading for the first time and wondering what terms mean.

Overall, ADSS is a good broker

ADSS offers a substantial range of trading instruments – including spot forex and CFDs on stocks, indices, commodities, and currency pairs. As a broker that is based in the UAE, there is the added appeal of the website and resources in English and Arabic, access to GCC-based instruments, and an economic calendar that takes into account economic developments in the Middle East.

Authorised and regulated by the SCA, the broker has a good and transparent history of serving global markets. Overall, we can conclude that ADSS is a fine broker for traders of all levels and types, including retail, professional, and institutional market participants.

Be First to Comment