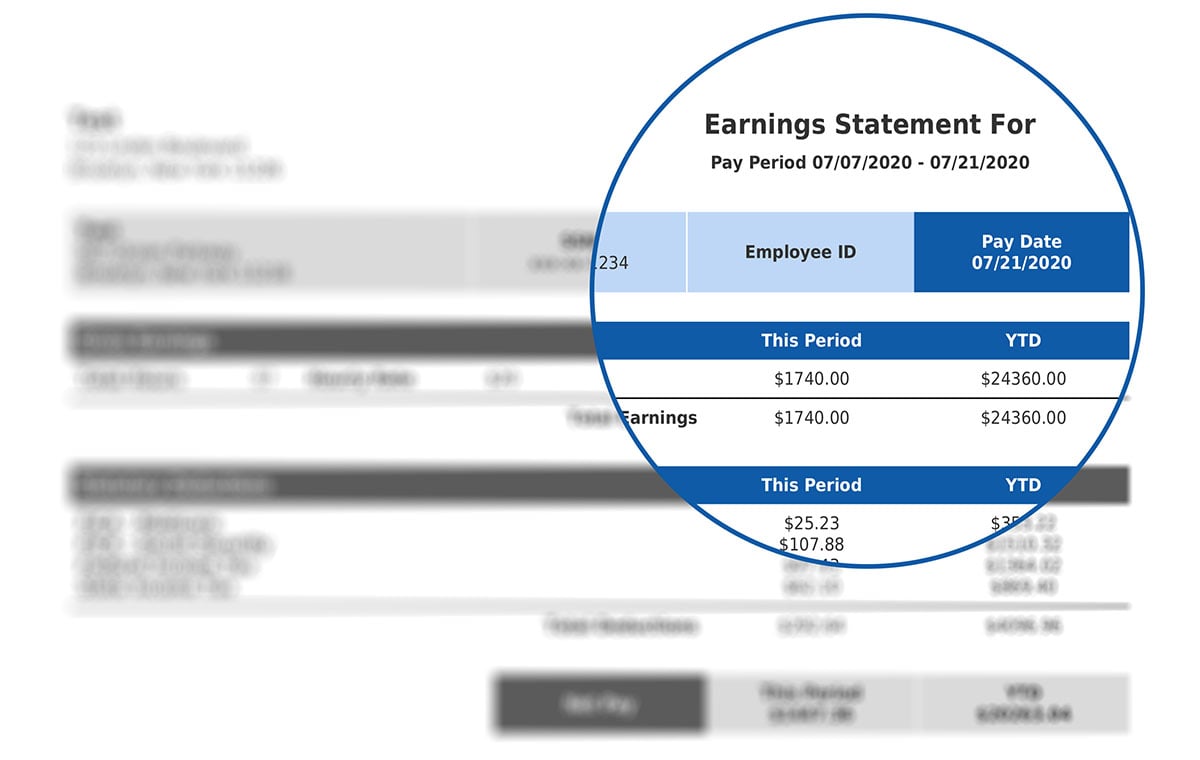

Paystubs are documents employers in a company give their employees as proof of all their income dealings. Other businesses refer to them as payslips, paycheques, or cheque stubs.

It is an official document that a company uses to know the exact amount an employee or freelancer has received from the company. The document can be given to an employee in printed or electronic format.

Paystubs contain the following information:

- Salary details

- Taxes withheld

- Employee’s personal information

- Net pay for salaried employees

- Social security number

How Do You Create a Pay Stub Online?

Many businesses prefer creating paystubs electronically. Both employers and employees prefer the e-stub because; they are easy to access and store, and at the same time, they are secure.

With technology evolving and growing so fast, creating a pay stub online is now easy. You can use a paystub generator that is easy to use and efficient.

A paystub creator is an online paystubs maker that ensures instant delivery of your paycheck. It has made payroll processing easy and fast. It is an accurate and secure payroll software with no subscription charges.

This tool is a must-have for all entrepreneurs and companies because of its working efficiency. With the software, you can make pay stubs, print or email them on the go. However, you must choose the best paystub generator to avoid unnecessary, illegal trouble with your business.

Who Needs a Pay Stub?

- Entrepreneurs

Entrepreneurs, Freelancers, contractors, and consultants do not have a steady and consistent income. Having a paystub is proof of income. They need to keep the documents for reference or use when the need arises. Using an online check stub maker can help track all business earnings, deductions, and withholdings.

- Employers

Employers and companies should keep a record of their employees’ payslips. It will help you during tax filing and is proof in case of a dispute concerning earnings with your employees.

- Employees

Paystubs are necessary for employees to monitor their earnings, verify calculations and also use them as proof of income.

Why Is a Pay Stub Crucial?

Paystubs are essential to both employees and employers. They serve as proof of income documents. Other functions of paystubs may include:

- Help in verifying your gross wages; shows whether deductions and withholdings are correctly made.

- It can help you as an employee to get a loan from the bank

- It makes tax filings for both employees and employers easy

- It can be used for compensation in case of a business-related accident

- Real estate agents and landlords use it to decide on renting out their property

What is the Meaning of Abbreviations in Paystubs?

Paycheques have acronyms that an employer or employee should be familiar with for easy interpretation. Here is a list of such acronyms and their meaning:

- MEDICARE – federal Medicare withheld

- FED TAX- federal income tax withheld

- STATE TX- state income tax withheld

- LIFE- Life insurance deductions

- GROSS- earnings before deductions

- YTD- the year-to-date code

Bottom Line

Paystubs are crucial documents for both employees and employers. They ensure transparency in all income dealings.

Be First to Comment